An MWC about regulation, APIs and AI would be depressing

Besides sounding off about local authorities, operators are expected to gabble excitedly about network APIs and generative AI. Let's pray for something better.

We're into the instrument-tuning build-up to this year's Mobile World Congress, when the main performers twiddle knobs and rehearse lines, and the roadies of press relations and marketing assemble props and bury the industry in news about widgets. For analysts and reporters downstream of this, it is a noisy few days spent trying to pick out a few melodious notes while appointments are cancelled or rearranged. After doing it for two decades, this correspondent would advise newbies to invest the time in other pursuits. Skiing is just-about doable on Europe's slushy slopes, and it probably holds greater rewards even if you're still at that awkward snowplough stage and look like someone nervously getting up from the toilet.

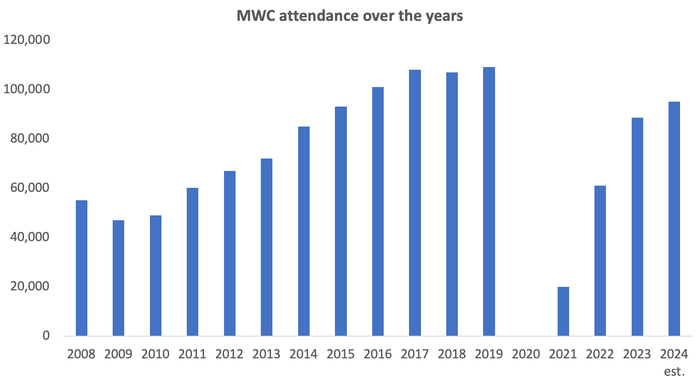

Sadly, but not surprisingly, the 2024 edition is unlikely to bring much new news. That won't stop the punters from piling in like grey-haired rock fans who turn up to watch Mick Jagger sing "I can't get no satisfaction" year after year. Some 95,000 are expected at the turnstiles of Barcelona's hangar-like Fira Gran Via, surely the ugliest part of what is a largely picturesque city. This would be 6,500 more than it welcomed last year, since when the big three US operators have cut more than 28,000 jobs. Just who are all these MWC attendees?

Certainly not former US telco employees hired to work in Europe, whose operators have also found ways around tougher employment laws to slash headcount. At 95,000 attendees, MWC would be just 14,000 short of its outrageous 2019 peak, before nature reacted to such overcrowding and inflicted COVID-19 on us. Many, undoubtedly, work in other sectors and see opportunity in telecom, much as ticks do in old dogs. This is clearly how Internet companies are seen by telcos pushing for them to make a "fair contribution" to network costs, even if no telco wants them brushed off.

(Source: GSMA, Light Reading)

Four players good, three players bad

Like the ancient Rolling Stones frontman, telcos can't get no satisfaction. The latest regulatory impertinence came when the high priests of the European Commission this week blessed a Spanish merger between Orange and Másmóvil on condition they sell spectrum and do a roaming deal with Digi, heretofore merely an MVNO with no network of its own.

It's Italy 2016 all over again. For anyone who's forgotten the story, Three and Wind were similarly allowed to merge provided they open the door for the appropriately named Iliad, an enfant terrible of French telecom that used the Trojan horse of spectrum licenses and roaming deals to smuggle in cutthroat tariffs and aggressive plans. Italy remained a four-player market and became even more competitive. The new-look Wind Tre suffered worse than anyone.

This hasn't stopped Orange boss Christel Heydemann from cooing about the deal as a "crucial moment" for her company's development. But it'll be worth checking back with her a couple of years from now to see if she's remained as ebullient. For any other telco, this is proof the EC hasn't changed and still believes in the sanctity of the four-player mobile market. In all likelihood, it always will.

Telcos should probably give up and move on, past this and their playground whininess about fair contribution. But this would require them to have good ideas about growth, and none does. Just about everyone agrees the two big themes at this year's show – other than regulation – will be network APIs and generative AI. And it's hard to feel much genuine excitement about either.

API mayhem

The first thing to say about network APIs is that it mystifies the broader investment community – not a good start – and is so convoluted that demystifying it may be impossible. The basic idea, though, is about selling network features, and specifically 5G network features, other than pure connectivity. Thus far, these have been inaccessible to the people who write apps, like money in a padlocked tin, and so no apps have been written to make use of them.

An individual telco could try exposing them via APIs (application programming interfaces). But developers are turned off by the notion of coding for individual telcos and having to rewrite software dozens of times to reach a global audience. Telecom has responded by congregating around Camara, an initiative to create a standardized set of APIs.

So far, so good. Where it gets messy and more complicated is on what happens next. The original, sensible premise was to have what Howard Watson, the chief security and networks officer of BT, recently described as a single "clearinghouse," a commercial entity for the whole industry that would charge a transaction or development fee for the standardized API. "I think this is the right vision because the complexity of a developer having to pay every single operator will be a big deterrent to consumption and adoption," he said.

Naturally, of course (this is telecom), individual operators have instead gone ahead and begun offering their own Camara-compliant APIs directly to the market. Deutsche Telekom did it last year and big operators including AT&T and Verizon have joined it in 2024. The implication is that your American bank, seeing value in writing an app that exploits the power of 5G, must transact with multiple operators to produce something for its entire market. That's the kind of problem standardization was supposed to fix.

What BT calls the "aggregators" – the likes of Ericsson, with its Vonage platform – will also want their cut. "What I want to really understand is where is the money going – into which part of this – because the last thing you want is the aggregation piece taking too much of a percentage of the overall value chain," said Watson.

Of course, the billion-dollar question is how much value developers (or consumers) see in these 5G features exposed through APIs, because none sounds terribly exciting. Deutsche Telekom has advertised a location-based feature, which could help tackle financial fraud by allowing banks to pinpoint customers. But Internet companies and GPS systems already do a pretty good job on location (it's called Google Maps). And banks won't be able to avoid asking customers for permission.

Then there is the famous "quality of service" feature, designed to provide latency guarantees or a speed boost. The average sentient being is likely to respond by asking why quality of service isn't good enough anyway. The industry, after all, has promoted 5G based on megabits per second, gigabytes of monthly usage and (albeit to a lesser extent) latency – not by saying it smells better than 4G or comes with prettier masts. Importantly, too, no API will overcome the problem of a knackered basestation or propel signals in high frequency bands through the thickest walls. Explain that to your basement-dwelling gamer after he pays extra for a quality-of-service guarantee.

A trade deficit with Big Tech

Talk of network APIs as a big thing shows how low industry ambitions have sunk since the dotcom days. It's the reality of the odd Sunday League game that follows the dream of playing football for England. But if APIs are a tad depressing, the elephantine stampede toward generative AI is much worse. Network APIs, at least, seem born of telecom. Generative AI is an import by an industry that already had a massive trade deficit with the Internet giants behind the tech.

Loathed and derided as "large traffic generators" in the fair-contribution debate, those Internet giants provide most of the apps that run on telco networks and that justify buying an up-to-date and pricier telco service. They are sucking telco IT systems into their public clouds, selling core network systems against traditional vendors like Ericsson and Nokia, and selling communications services directly to business customers. With the large language models (LLMs) of generative AI, they could dramatically extend their influence over telcos, and do it in the very brains of the operation.

As always, telcos fear missing out on business benefits if they don't join the stampede. But there is also fear of hyperscaler dependency. "If you want to use multiple LLMs and they were too tightly coupled to the hyperscaler that provides the LLM, you would have to replicate the data for every hyperscaler you wanted to use," said Scott Petty, the chief technology officer of Vodafone, at a recent press briefing. "We have to have a model where you choose to put the data where you best want to put it and have openness in the way that LLMs work."

Amid the keynotes and fanfare about regulation, network APIs and generative AI, there will be the usual low-level chatter on topics such as the Gs, cloud-native technology and the open radio access network, several of which have fallen from lofty pedestals in previous years. It's entirely possible MWC 2024 throws up something leftfield, like a hallucinating chatbot. But few regular attendees will expect to be surprised.

About the Author(s)

You May Also Like